Above a certain amount of assets, wealth is extremely relative.

The goods that most people consume have fairly fixed prices. Some go up 1-10% per year. Some go down 1-10% per year. The prices of the goods and the basket of those goods are fairly predictable.

For most people, wealth is absolute. It is not really about keeping up with the Joneses … it is about keeping your head above water and doing everything possible for your family to have a normal life.

But once your assets cross a certain threshold, almost all your spending is relative to the Joneses. The amount of absolute wealth no longer matters — what matters is the amount of wealth relative to your peers.

Most goods that cater to the wealthy (high-end real estate, charitable giving naming rights, art, buying 10% of a YC company, etc.) are extremely relative. And most really wealthy people are trying to protect their status — their biggest worry is a new class of people getting richer than them fast.

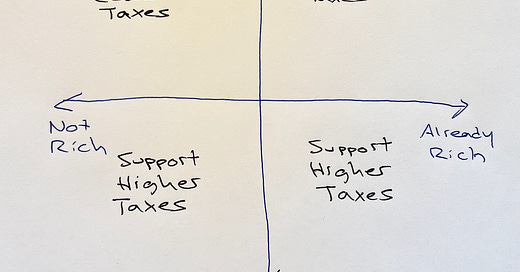

For the super wealthy, the easiest way for them to protect their wealth is to raise taxes. The higher the taxes, the easier it is for wealthy people to maintain their status and to stop pesky outsiders from usurping them.

It is not like wealthy people like paying higher taxes. They don’t. They just want to make sure that the tax code is designed in a way to hold off people trying to jump above them in the wealth ladder. Because once you get to the higher levels of wealth, every rung on the ladder matters — and the number of rungs is fixed and there can only be a fixed number of people on each rung.

One of the advantages that really wealthy people have, is they rarely have to pay taxes. Yes, they may have had to pay some taxes over the years to get to their level, but now they can fund their current lifestyle with savings (or by borrowing). They can sell at their convenience. If taxes go up, they have the ability (and luxury) of not selling. If you never sell an appreciated asset, you never pay taxes on it.

Europe is a good example of this. So many of the wealthiest families are descendants of the wealthiest families from 1900 (and, in some cases, 1600). In Europe, old money rules. They have designed the rules in Europe that is really hard to usurp status. Status often persists from generation to generation. In Europe, the usurpers are often people who made their money in other countries and then move to Europe for the express purpose of buying status (like the stereotypical Russian billionaire).

The usurpers (like most of the first-time tech entrepreneurs), are trying to get rich, get on the ladder, and kick off some of the older money (which in the U.S. might be people that made their money 20 years ago) down to the lower rungs of the ladder. The usurpers are looking for status. And the easiest way for the already-wealthy to protect their position is to increase taxes.

The usurpers are not yet rich. They are trying to get rich. If they do eventually make money, they get to keep whatever is left after they pay their federal, state, and local taxes. The usurpers usually can’t pick and choose when they sell. They cannot hold on to an asset just because they don’t want to pay taxes. They don’t have the ability to borrow money against their assets (which is the tax-free way the super-rich get to spend money). The usurpers are the big tax payers.

And the higher the tax rate on the usurpers, the easier it is for the already-rich to stay relatively rich.

We’ve seen an incredible run by usurpers. As Paul Graham writes in his piece “How People Get Rich Now”:

In 1982 the most common source of wealth was inheritance. Of the 100 richest people, 60 inherited from an ancestor. There were 10 du Pont heirs alone. By 2020 the number of heirs had been cut in half, accounting for only 27 of the biggest 100 fortunes.

One of the biggest reason that inheritance used to be the source of wealth of the richest people was that the tax rates used to be much higher. So it was much harder to get rich which means the richest people were likely to be the people whose parents were really rich. Again, at the top end, wealth is extremely relative.

Since 1982, the U.S. has significantly lowered tax rates (through both Republican and Democrat administrations) which made getting rich much easier. Since 1982, so many new people had the ability to get rich.

But now all those people who got rich since 1982 want to protect their status. They want to remain on top. They don’t want new people to get rich — or at least make it much harder. These former usurpers are now at war with the new usurpers. And the best way to do that is jack up the tax rate.

Auren, you have a gift for glib perspective. It's usually amusing and sometimes insightful. In this one I think clever has won out over reality and it unfortunately minimizes a real crisis in American capitalism that impacts our system's ability to function. The drop in tax rates and other policies since 1982 did make it easier to get rich, but only for the top 1%. This has been a tremendous driver of inequality, enabling that top 1% to capture nearly all of the economic productivity gains in the past 4 decades. For a quick easy read see https://time.com/5888024/50-trillion-income-inequality-america/, or choose any review of the Gini coefficient in the US over time. In turn, that inequality has led to economic frustration that set the stage for the anti-democratic political destabilization that we are seeing in the US today. Maybe many of the already rich are more comfortable with higher taxes because they realize that if their fortune is cut from $100M to $75M or even $50M it will make no difference in their financial security or daily enjoyment. Maybe they have the luxury of stepping back to see the columns of the republic crumbling and wish to see it change. Maybe they realize their fortunes aren't worth much if the country they're in doesn't support the basic needs (like healthcare and a living wage) for a large portion of its citizens.

If you think the wealthy want higher taxes to preserve their wealth, you haven't kept up with President Biden's tax plans.