For those of you that missed the SaaStr SCALE conference last month, Jason Lemkin has a great overview including links to the top eight presentations.

The #1 rated session was an interview with Todd McKinnon, CEO Okta — it was excellent and I highly recommend it.

My presentation was the #2 rated session. Here is the full video:

And here is the full learnings:

(1) Avoid good opportunities

the MOST IMPORTANT advice I can give you is to avoid good opportunities.

avoid good opportunities like you work to avoid the coronavirus.

Good opportunities must be avoided at ALL costs.

this is true if you want to build a great company ... but this is JUST AS true in life.

the more successful you become, the more good opportunities are going to come at you. soon you will be swimming in good opportunities.

again, that's true for companies and true for you individually.

let's first dive into this advice individually and then show it applies to building a business.

let's say you are 22 years old and don't have any money. well then you are likely going to see very few opportunities to invest and most of them will be bad. but as you gain wealth, you will see more opportunities to invest -- and many of them will be good. but even the good opportunities take time and effort to review -- so it is in your best interest to do everything possible to wait only for the great opportunities.

this is even more true when running a company. the possibilities of the number of things you can do to grow your business are endless. you can launch new products, be better at recruiting, speak at SaaStr, and so much more. my advice, have some sort of rubric that allows you to ID good opportunities and avoid them.

but how do I know when an opportunity is just good and not great?

my simple heuristic: if the opportunity has few obvious downsides, it is almost certainly NOT a great opportunity. all great opportunities have very big and very obvious downsides.

of course, just because it has obvious downsides doesn't mean it is a great opportunities -- it still is more likely to be a bad or good opportunity ... but if you see something with no obvious downsides, it almost certainly is not great.

this is also true with people you hire. if you want to hire a 10xer, that person will almost certainly have glaring faults. anyone that you can hire without glaring faults will, at best, be good -- they will certainly not be great.

summary: avoid good opportunities like you avoid COVID-19

(2) Delegate things you are good at

most people advise us to delegate things you are not good at. they advise to surround yourself with people that have different strengths and different weaknesses.

this is the conventional advice.

maybe someone on your board already gave you this advice.

most of us have heard this advice many times over the years.

but this is terrible advice. don't listen to it. ignore it. take it outside in the backyard and bury it. stab it and kill it.

do the opposite.

instead: Delegate the things that you are good at.

I know this sounds really strange ... so let me explain.

the things that are the EASIEST to delegate are the things you are already good at. you know how do those things really well. you might already be an expert in them. you can break down these things well. you can also hire for these things.

so delegating these functions will, for sure, have the highest success rate.

if you are a great engineer, who do you think you will be better at hiring -- other great engineers or great salespeople?

the answer is obvious -- you will likely hire super engineers and very mediocre salespeople.

so the first thing you should always delegate are the things you are best at.

I cannot stress this enough.

you even see it in all great companies - they rarely get great in things that are not traits of their founders.

for instance, Marc Benioff is the world's best software marketers. he was an amazing software marketer ever before he started Salesforce. he's incredible. he's hired great marketers and delegated to them. Salesforce continues to be great at marketing.

but Marc Benioff is not a great UI/UX person. while he's been able to acquire great UI/UX people through acquisitions over the years (Stuart Butterfield, CEO of Slack, is one of the world's greatest), the Salesforce product still suffers from having one of the worst UI experiences.

and guess what? it hasn't mattered.

it is better that Benioff focused on his strengths.

you should focus on your strengths too -- you cannot be all things to all people. focus on being great at just a few things.

let's look at the napkin graph (above).

on the y-axis is things you are good and things you are bad at. the x-axis is things you love to do and things you really hate doing.

when you get a chance, try to fill out these quadrants for yourself.

the easy thing is to delegate as much as possible on the things you are already good at.

build systems to make delegation easier. hire super talented people and work on up-leveling them.

now you have two other buckets left.

for the things you like to do but are not yet good at ... work on investing in yourself. get a coach. read. learn. try a few different things (and know that you will fail). while it is unlikely you will ever become great at these things ... you can get yourself to good. once you are good, you can better effectively delegate (and hire).

now there are things that you are bad at and you also do not like doing. my advice in this quadrant is to do everything possible to get leverage through APIs or software ... or maybe you do not need to do them at all. remember, you don't have to do everything to have a super company. there can be many functions that you either outsource or just not do.

the great thing is that the number of vendors you can choose from is growing exponentially. you have amazing choices.

the number one skill to have in the next 20 years is the ability to select and manage vendors -- almost every company now has more vendors than employees.

(3) Do the opposite of “smart” people

take a look at what the smart people around you are doing ... and do the opposite.

most smart people optimize for the mid-term.

they delay gratification in the short term (they are experts at passing the marshmallow test) but while they think they are optimizing for the long-term, they are actually optimizing for the mid term.

this explains why so many really smart people go to law school.

if you are going to go to law school, go because you have a true love of the law.

don't go because of optionality. don't go because you are getting your ticket punched.

most of the people who go to law school don't love law school and certainly do not love their first few years out of law school where they are in a grind. but they go because they are optimizing for 7 years out from law school when they will make partner.

they are optimizing for the mid-term.

never do things just to get your ticket punched.

never do things to gain optionality. optionality is bad. have a purpose-driven life.

the smartest people never optimize for the mid-term.

in the short term they focus on learning and growing -- often in areas that are very non-obvious.

they might do things that are a little remote. they are certainly not being conventional. in college, they are probably not choosing a popular major. they are being different.

smart people stay in jobs with bad bosses (they deal with bad things in the short term). the smartest people never would have a bad boss. they always get out of that situation.

smart people are always thinking 10 years out. the smartest people are always thinking 10 days out and 30 years out.

don't be like the smart people. be one of the smartest.

(4) Create companies to dominate

it is a LOT easier choose which companies to invest in than to choose what companies to start.

to make money as an investor, you need be both unconventional and right. it is not enough that you are right ... because if it is conventional it is already priced in. you also need to have a different view of the world than other smart people.

when you start a company you too need to be unconventional and right -- but you need a third element -- a true ability to get the business done.

if I want to start an energy business, it is not enough to think the future is super small nuclear fission reactions. and it not enough to be right about that prediction 10 years later. I also need to have a unique advantage to start and run that business. in this case, I personally have no such unique advantage so it would be folly for me to spend the next 10 years of my life to this vision.

given that you can start a small number of businesses in your lifetime, this is a very good Venn diagram napkin chart to consider before diving in head-first.

(5) The reasons for a VC “no” are lies

when a venture capitalist turns you down, the reason they give you is usually a lie.

it is kind of like Leo Tolstoy's first line of Anna Karenina: "All happy families are alike, but every unhappy family is unhappy in its own way."

reasons that VCs give you for wanting to invest in your business are usually true but reasons they give to not investing are usually lies.

the number one reason why a VC will pass on your business is that they do not like the team. this is especially true on seed and Series A deals.

of course, they will not tell you this.

one reason that many VCs will give for not investing is that your Total Addressable Market isn't big enough. this is pretty much never the actual reason. VCs will happily invest in businesses with small TAMs if they think the team good enough to move to an adjacent TAM once they are no longer growing 100% a year.

so while getting advice from VCs that pass would be super helpful in theory, in practice the advice is not worth considering because it will rarely be true.

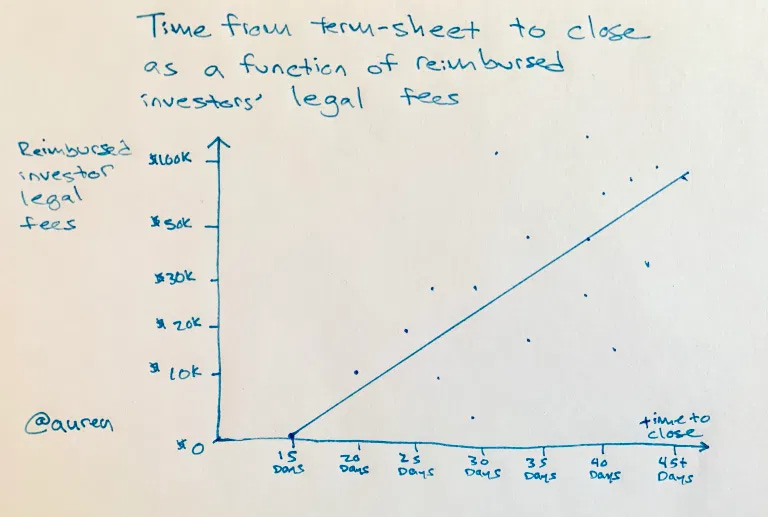

(6) Decrease time from term sheet to close

one you are lucky to get a term sheet from your favorite VC, you will have a lot of options to negotiate many different terms: like certain rights, valuation, lock-up period, board seats, etc.

most of these terms are win-lose and thus contentious to negotiate.

the most non-obvious clause to negotiate is the amount you are supposed to reimburse the investor's legal counsel. you are actually doing your investors a favor by negotiating this -- this is actually win-win.

the time it takes you to go from term sheet to close is a function of how many dollars that are in this clause.

this is also the first thing that your lawyer and your investor's lawyer will look at -- this will tell them how much they are getting paid. this is a core signal to the lawyers of the investor's view of the complexity of the transaction. the more complex, the bigger the fees (remember: investors do not want to pay legal expenses out-of-pocket).

assuming your company is pretty vanilla, there is no need to signal to the lawyers that this transaction is complex. remember, both law firms are going to take their cues from this one number. if the number is large, they will need to justify their fees by adding work and nitpicking on very small points.

and that will result in a much delayed closing.

if the number is smaller, nitpicks will much less prevalent and time to close will be much speedier.

in addition, the win-win comes because it will:

take less time for you and the VCs to close -- so you can both focus on more important things to do

the company will able to use its treasure for more important things than covering legal nitpicks.

(7) Startups: Doing > Planning

In start-ups, doing trumps planning.

Planning is really important when figuring out your market and which company to start (remember the fourth graph).

and planning is really important at very large companies that only can do 1-2 new things a year.

but small companies win by doing. they win by moving fast and then reorienting and moving again.

air force pilots learn about OODA loops -- which stands for observe–orient–decide–act. they move fast.

my favorite quote from Jeff Bezos is: “Being wrong might hurt you a bit, but being slow will kill you.” like Maverick in Top Gun, you must feel the NEED for SPEED.

(8) True 10xers need active management

this one came from one of my discussions with Jason Lemkin.

the better the person, the less time it takes to manage them ... up to a point. the true 10xers actually take MORE time to manage than the average performers.

if you happen to have a 10xer on your team, you need to make sure you are giving them more of your time and love. these people require more time but will give you much more in return. but remember, they do take more invest than the typical high-performers.

ok ... let's recap everything we learned today:

Avoid good opportunities

Delegate things you are good at

Do the opposite of “smart” people

remember our Venn diagram on how to start companies

The reasons for a VC's “no” are lies

Decrease time from term sheet to close by negotiating the legal fees term

in startups: Doing > Planning

True 10xers need active management

PSA: More at @auren on Twitter

Like this? Send it to a friend.

Hate this? Send it to an enemy.