trigger warning: there is a lot of pouring cold water on data businesses

Five years ago, I made a full-throated argument that now is a great time to build a pure-play data (DaaS) business and put my money where my mouth was – starting and investing in dozens of pure-play data businesses. This was on the back of the DaaS Bible.

But I was wrong. This was a mistake.

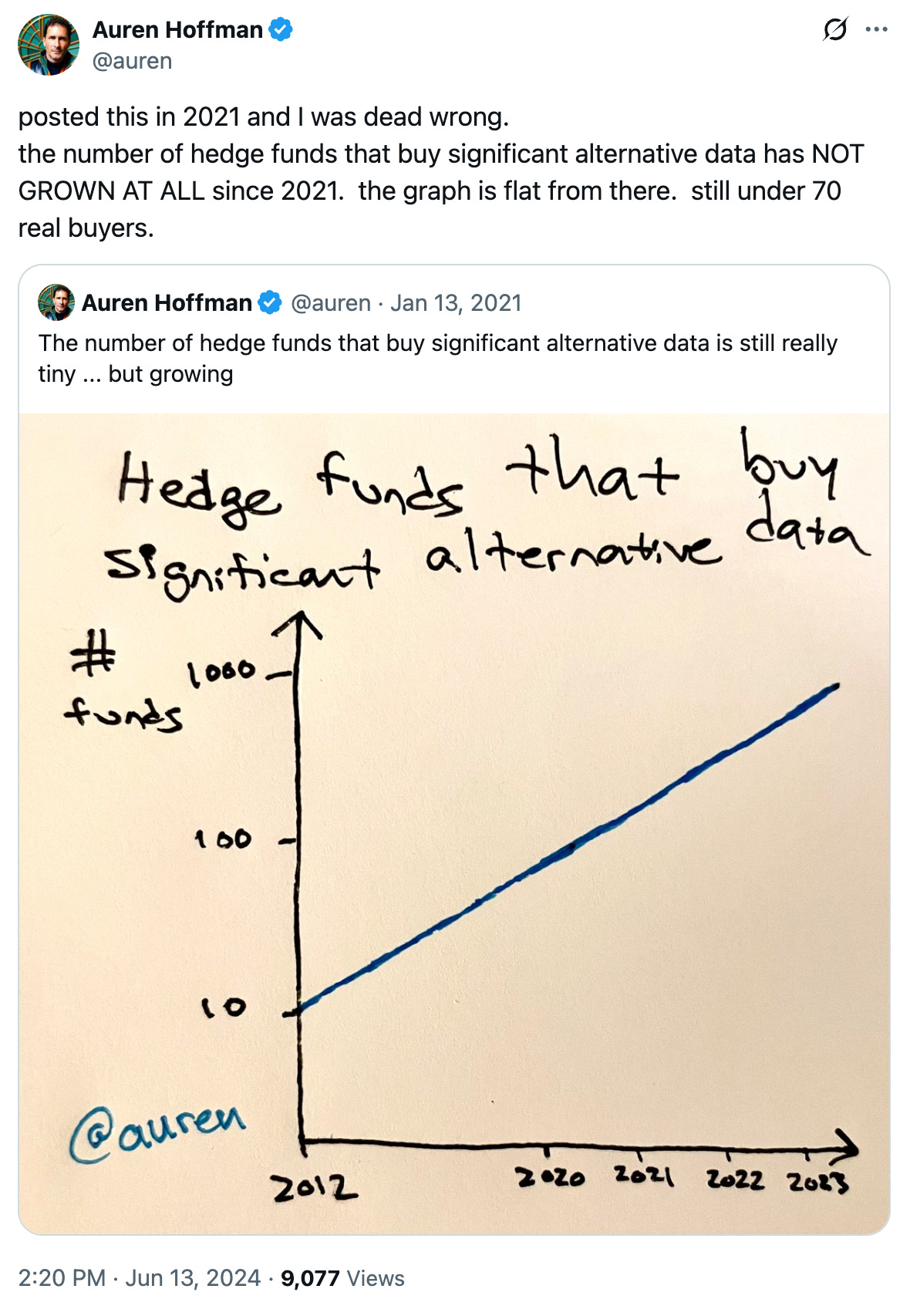

My main argument was that that number of data buyers was sure to grow exponentially. Companies were getting much more data-forward (investing in data lakes, snowflake, databricks, etc.) and employing armies of data scientists. Surely they will need to buy more data. And this was even before the AI wave.

I wrote:

One example is hedge funds. Not that long ago, just ten funds were buying significant alternative data. Today it is still under 100. But there are 500-700 funds that are currently making the investment to ingest large amounts of data.

But today, there are actually fewer than 100 hedge funds that spend millions on alternative data. the number of hedge funds buying a lot of data is going down, not up.

there are fewer funds that spend a lot on data than there were 5 years ago. Even one of the largest hedge funds, Bridgewater, barely buys any data.

And this is true across the board. Ten years ago there were zero real estate companies buying significant data … today there are still less than 5. There are still very few retailers that buy data. There are lots of financial services firms (think banks) that buy data but most of that is from data companies started over 40 years ago and have used regulatory capture to cement a duopoly.

But AI to the rescue? Well, not really. There are some new AI company buyers that have entered the market. But there are very few AI companies that buy data. And they do not always have a recurring need for that data (will be interesting to see where the Google/Reddit deal re-trades at once it expires next year).

so the market for data did grow over the last ten years. it is certainly bigger today than it was. but it not grow nearly as fast as any of us predicted. and that’s because getting value from data is still SUPER hard.

does AI make it easier? yes. but so did all the other innovations in the last ten years and those innovations did not meaningfully grow the market for data.

Data businesses (companies that sell data – think rows and columns) are good businesses. They make good profits. They grow (albeit slowly) well. But they are not great businesses – and most should not take venture capital funding.

“Rows, Columns, and Regret” – The Costly Illusion That Data Can Scale Like Software

In the last 20 years, there have been about 1000 SaaS unicorns. There has been roughly one DaaS unicorn: ZoomInfo (NASDAQ: ZI). And ZoomInfo never took venture capital (they did do secondaries along the way but they were always profitable … from even day one).

Venture capital is great for companies that need to lose a lot of money for a while and fuels fast growth and deep R&D. the best data companies are profitable and grow profitably. We’ll see more DaaS unicorns in the future, but they will not take venture capital. Yes, they might need a bit of seed capital … they’ll take debt to buy other companies … but they do not need to raise tens of millions in equity financing.

There are only 60 publicly traded DaaS companies in the world and most of them were started over 40 years ago.

It is kinda weird that most of the super large DaaS companies are private. Nielsen, Kantar, Bloomberg are all private. In fact, PE firms LOVE data companies because they often have predictable revenue and often have high costs that can quickly be cut.

Data is PE, not VC.

getting back to venture capital … most of the VC investors in DaaS companies (including me) will not make even a double-digit IRR collectively. It is not a good category for venture. DaaS is a good business (that trades on multiples of profit) but should not raise outside capital.

“Starting a data business? Congrats, you’ve just invented private equity’s favorite acquisition target. VC returns not included.”

“Venture capital loves explosive growth. Data businesses grow like a bonsai tree: slow, steady, and only after years of careful pruning.”

“ZoomInfo is the only DaaS unicorn. That’s not a market trend. That’s a statistical anomaly.”

VCs: ‘We love recurring revenue!’

Data companies: ‘Great, we have that.’

VCs: ‘No no… we meant recurring losses at scale.’

“Data companies are like tofu: bland, stable, and PE firms love seasoning them”

“Started a DaaS company. It made money. Just not fast enough for the burn-hungry gods of Sand Hill.”

note: Flex Capital invests in 100 seed-stage start-ups per year (2 per week). typical check is $400k. please reach out if you know amazing founders that want to change the world.

X of the week:

if you like this article, please do three things:

share it with someone you admire

follow me (@auren) on X

subscribe to the “World of DaaS” podcast

(if you hate this, please share with all your enemies)

I'm building a data business with plans to avoid VC investment as much as possible. I actually appreciate how this article validates aspects of my approach. Thanks for your critical reflections on past positions.

1000% Agree